Research Article

Back to Research

01 April 2021

Trend Structure – Our School of Thought

By BH-DG Research

Introduction

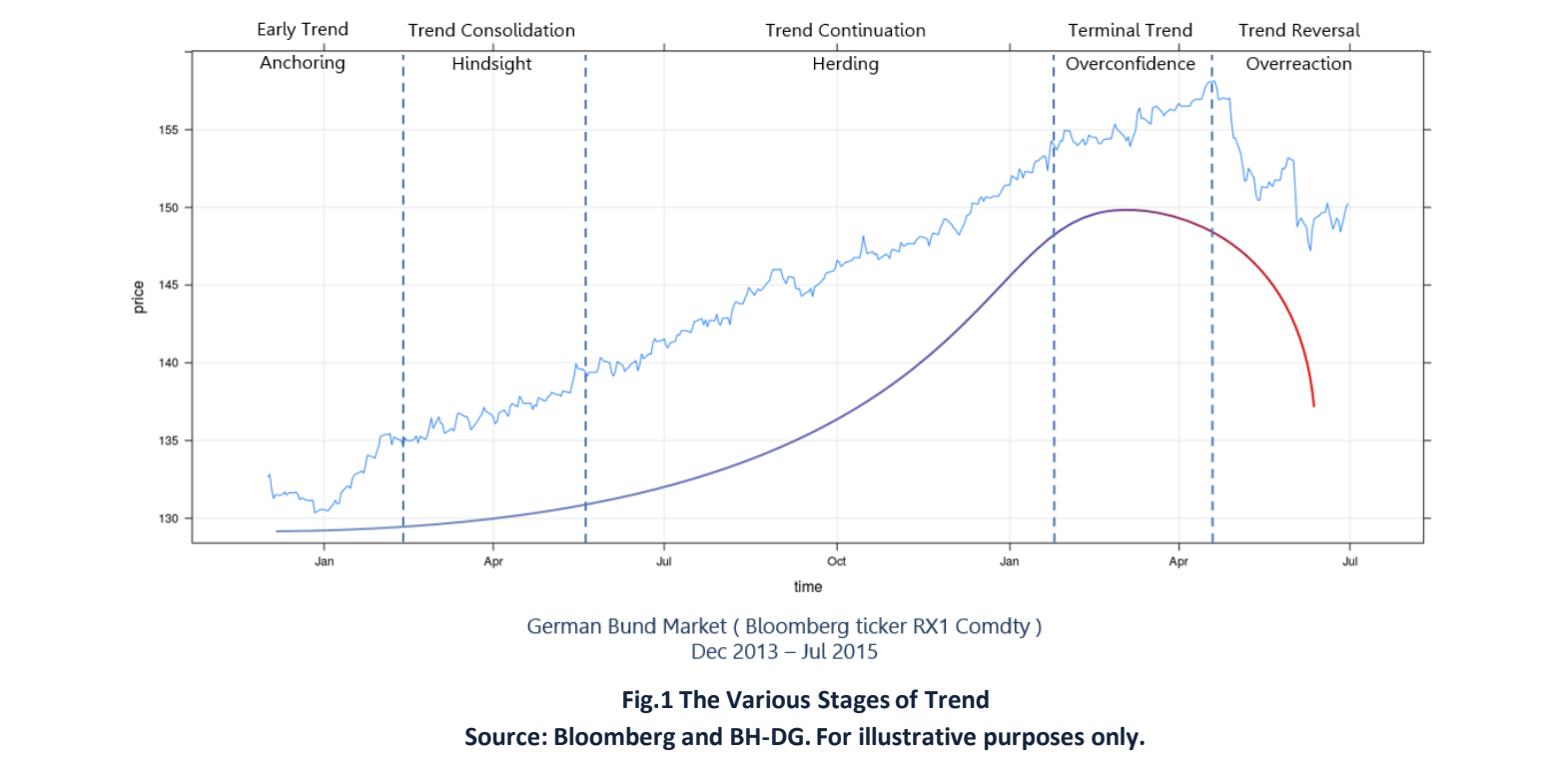

In our view, when trends do occur, they are not just mere prolonged rallies or persistent corrections experienced by markets. Our understanding of the structure of market trends suggests that this type of price action consists of a number of distinct phases that tend to be found in the same logical sequence as the trend develops (see Fig.1 below). We believe that a successful trend following model needs to discern between these distinct market modes and incorporate their interplay appropriately. Moreover, modelling each one of these phases requires a specific approach as the underlying trading ecosystem changes significantly from one phase to another. We set out below our thoughts with regard to each such phase.

Anchoring (Early Trend)

In the anchoring phase normally a new macro theme develops, and this may get the attention of certain macro

traders that can successfully time the early onset of a new market structure or regime. This phase can take the form of a breakout and when it does it may manifest itself as a strong, violent price action. Breakouts can often take place on the back of a market rumour or it can result in an overreaction that tends to diffuse away in time. The anchoring phase however is the market response to a genuine onset of a new macro theme and does not diffuse away but rather leads to increased market participation. This is the earliest part of a trend and it is essential to the formation of a medium-to-long term directional market price action.

Hindsight (Trend Consolidation)

If the abovementioned macro theme is perceived as being of little doubt, the anchoring phase can be succeeded by a market process referred to as hindsight. Like in all other professions, there is only a minority of traders that are constant top performers and they are generally known by the market. When such players are ‘detected’ as

participating in a particular direction in a market, their very presence can generate significant ‘adherence’ to their

market views from other market participants. The new ‘following’ would be trading on the basis of a ‘hindsight’

intuition and this can give additionalstrength to the market direction already defined in the anchoring phase.

Herding (Trend Continuation)

The macro theme which may be the underlying cause of the anchoring phase will undoubtedly have been known to most large asset managers right from the beginning. However, such heavily regulated market participants can take quite some time to ascertain whether or not the theme in question is stable and likely to persist for a sufficiently long period of time, often in relation, or in response, to a new economic cycle expressed by the respective market. However, when such organisations believe (often collectively) that the underlying story is strong, they may start to participate ‘en masse’ and in the same direction in the respective market or sector. This cumulative participation can take the form of institutionally sponsored order flows that are overlapping, causing an effect known as ‘herding’. At the same time, another category of market participants – market makers - start to notice this increased appetite for price taking and may view this strong market consensus as an opportunity to profit themselves. By offering increased levels of market liquidity within this phase, market makers can accommodate increasingly larger institutional orders, which in turn give additional strength to the trend in formation. This is, in our view the most stable and most persistent part of the trend and when it occurs it can extend over several months, possibly more than one year.

Overconfidence (Terminal Trend)

There is an ‘endless continuation’ type of feel about the herding phase due to its perceived stability. It is almost

paradoxical that as the institutional orders that dominate the herding phase now start to evaporate, other market

participants may expect ‘trees to grow to the sky’. When this happens, this phase is a very dangerous one and it is

termed the overconfidence stage of the trend. Often the price action is quite noisy in this phase as the trend

approaches its terminal state. In the overconfidence phase, market makers start to retreat so liquidity peaks and that often is a warning signal to many momentum traders that the potential for a reversal against the long-term trend is increasing.

Overreaction (Trend Reversal)

Given the dynamic of the terminal trend phenomenology, it is of little surprise that the subsequent phase is the

correction against the long-term trend. With the institutional floor of the price action having evaporated and

decreased market making activity, the price action can often be quite sudden and violent in such a stage. Volatility is expected to be the highest here when compared to any other previous phase of the trend as panic now dominates trading activity, in complete contrast to the constructive nature of the herding phase. Trend reversal environments often consist of high-amplitude oscillatory price structures that change rapidly (overreactions) – which is generally a very hostile market regime for medium-term trend following strategies.

Concluding Remarks

In this note we endeavoured to describe the various stages of market trend according to our school of thought. As presented above, we believe that trend following requires a surgical understanding of the underlying dynamics of the market forces at play. Of particular importance is the acknowledgement and the appropriate timing of the several phases that make up the trend price action and the realization that these phases are vastly different. We conjecture that a good trend following strategy should take into account the individual characteristics of these different phases and produce sufficient resilience in its behaviour as the trend evolves across its various stages. For illustration, the purple profile shown in Fig.1 represents the idealized position sizing mechanism that would characterize a medium-term trend-following strategy which responds appropriately to the various phase transitions. In the anchoring and hindsight phase such a strategy would allocate a relatively small amount of risk to a market exhibiting these phases but increasing the size with time.

In the herding phase, as confidence that trend exits builds up, ideally one would subsequently accelerate adding more risk to that position for the entire duration of this stage. In the terminal phase, one would ideally stop adding any further risk - in fact, one would want to protect the P&L by taking some partial profits. The purpose of this would be to align quickly with the prevailing direction of what comes next (the trend reversal) and to render the self-correcting nature of the trend following strategy as optimal as possible. Aggressive divestment of the existing position should be the main theme in the corrective phase.

We believe that such an approach, if properly tuned, has the potential to deliver positive alpha and a positive

skewness of returns in trends of highly variable time duration and speed of evolution, such as the post-2008 market environment.

Contact Information

For more information please contact:

[email protected]

Tel: +44-207-408-5200